Joel Davis,

Strategic Director at Image Property.

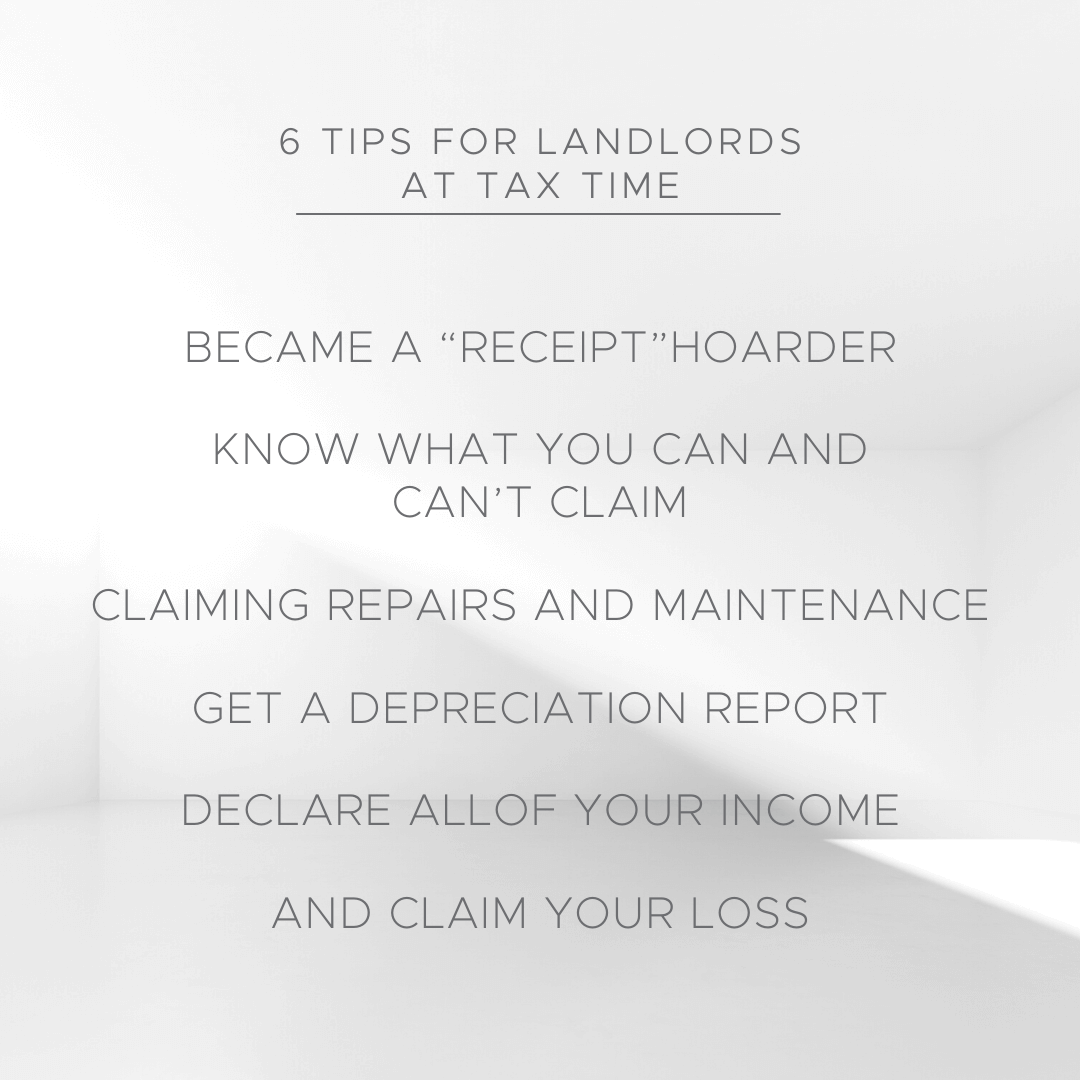

Six Tips for Landlords at Tax Time

[lwptoc]By Joel Davis, Image Property

With a new financial year here, it’s a good time for landlords to think about how they can get the most bang for their tax buck.

Whether you have one investment property or several, there are a range of things to keep in mind when you’re preparing your tax return.

So, here are six helpful tips to get on top of your tax affairs.

1. Become a “receipt” hoarder

This tip may be too late to be useful this tax time, but if you really commit to it right now, you’ll thank me in 12 months or so and then every year after that.

Become obsessive about record keeping. And I mean obsessive. Collect every single receipt (online or otherwise) that’s related to the cost of maintaining your investment property. Once you receive one, immediately catalogue it, so it’s at hand when it comes time to do your taxes and you don’t lose it.

There are plenty of free apps that allow you to snap a physical receipt and save it in a secure location. Likewise, start a file on your computer now to record relevant investment property-related expenses.

Plus, a professional property manager will also use software that records all the invoices and expenses associated with your property, which can be supplied to your accountant at the end of each financial year – so don’t need to become a receipt hoarder at all.

This record keeping will also come in handy should you sell. You’ll need an accurate record of all income and expenses related to the property to determine whether you’re making a capital gain or a capital loss.

2. Know what you can and can’t claim

You’d think that the money you’ve just dropped to buy an investment property would be deductible in some way. Think stamp duty. Think conveyancing fees. Think the building and pest inspection.

This is a common question from new landlords and it kind of makes sense.

Unfortunately, you can’t claim most deductions for the cost of buying your property. But keep a record of these expenses for down the track because they’re used when working out if you need to pay Capital Gains Tax when you sell.

What you can claim is the cost of getting the property ready to rent. This could include a cleaning service to get it spruced up before the lease, photography for the vacancy listing, advertising, insurance premiums, and of course, property management fees.

You can also claim other expenses like council rates, strata fees, water bills (provided you don’t pass this cost onto your tenant, as some states allow) and land tax. You can also claim as a deduction ongoing expenses, such as garden maintenance, pool cleaning, and pest control.

You can claim the interest you pay on the mortgage though. But only the interest repayments – not the principal.

And if you’ve refinanced or redrawn to fund the purchase of something not related to the investment property, like a boat or a holiday, you can’t claim the interest payable on that portion of the loan.

You should always seek professional advice to avoid making a claim you’re not entitled to – ignorance is not a defence for tax avoidance!

3. Claim repairs and maintenance

If you own a rental property, it’s inevitable that you’re going to have to undertake maintenance and repairs at some stage.

Even a careful and considerate tenant will cause some wear and tear, and unexpected issues crop up regardless, like a blown hot water system or a leaking tap.

The good news is that you can claim the cost of these repairs and maintenance… but it’s a little tricky as some items can be claimed right now, in the current tax year, while others must be claimed over time.

Let’s say the hot water system has blown and you need a new one. Or there was a horror storm and part of the roof was damaged, requiring emergency repairs. Those are considered ongoing repairs directly related to wear and tear, or damage, as a result of the property being a rental.

You can claim those in full in the tax year in which they occurred.

But repairs for any damage that was there when the property was purchased, like replacing dodgy lighting, pulling out new carpet, or fixing missing floorboards, aren’t immediately deductible in full. Instead, they should be claimed as capital works over a number of years.

Similarly, if a modest repair is required but you go for the whole hog and do a full replacement, that’s likely classed as an improvement and can’t be immediately deducted. Let’s say you replace the whole roof after that horror storm, when only part of it was damaged.

What you can claim and when can be a bit tricky so always seek advice to make sure you’re on the right track.

4. Get a depreciation report

If you don’t already have a depreciation report, it’s another tip that will come in handy next time around and could improve your tax position at the end of each financial year.

Basically, a depreciation report is an official assessment of the declining value of items within your investment property, which you can subsequently claim as a deduction. Think stoves, dishwashers, heating and cooling appliances, hot water systems, various other fixtures and fittings, and even the carpet.

A quantity surveyor will assess your property and prepare a depreciation schedule that will satisfy the requirements set by the ATO and make it simple for you to plug in your data when completing your return.

Again, the criteria for deprecation can be a bit tricky. For investments acquired after May 2017, you can no longer claim depreciation on items that were already there when you purchased.

It’s vital to seek professional advice to make sure you’re only claiming what you’re entitled to – and not missing out.

5. Declare all of your income

Running the gauntlet when it comes to tax is never a good idea.

Not only are you risking serious penalties if you attempt to be misleading, but it’s also not fair to the vast majority of Aussies who do the right thing.

For that reason, you should properly declare all of your rental income. And that doesn’t just mean the amount your tenants pay you each week.

If you’ve had any other cash come your way as a result of your investment property, that’s also income you should let the ATO know about.

It could be back paid rent, a payout from an insurance claim, or part or all of a bond that you’ve been able to retain. If you’re not sure if it counts as income, you should seek advice to make sure you’re not inadvertently doing the wrong thing.

Also, the ATO has indicated it plans to crack down on income derived from properties used as short-stay accommodation, on platforms like Airbnb or Stayz. If you listed your vacant property for a period, even if briefly, you’ll need to disclose any income you generated.

6. Claim your loss

Of course, property investors also have the ability to negatively gear. In a nutshell, this means landlords can offset any loss they make from their investment property against their own taxable income.

So, let’s say your property earns X rent but costs Y to maintain, the difference, if it’s a loss, can be used to offset your personal tax rate.

Property investment success really starts at the moment when your portfolio is paying for itself.

However, as it can take a few years to get to that point, it makes financial sense for landlords to be across what they can legitimately claim as an expense at tax time.